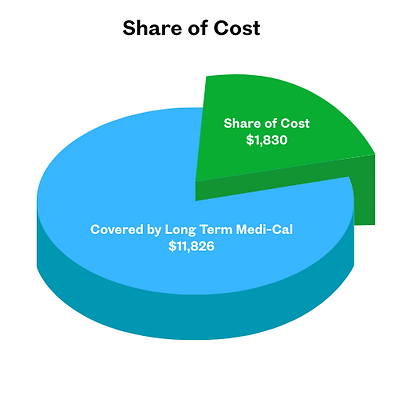

Share of Cost

Share of Cost (SOC) is a mandatory facet of Long Term Medi-Cal. Share of cost is calculated by determining all forms of income (gross not net) minus any secondary healthcare premiums (private BlueCross, Anthem, Kaiser, etc…) minus a $35 personal needs allowance.

The Average Private Pay Rate (APPR) in California effective January 1st, 2026 is $13,656. This is the rate that a resident would have to pay monthly if he/she were to reside at a skilled nursing facility and pay privately. The $9337 can be offset by utilizing Long Term Medi-Cal as a benefit. The person who receives the benefit, however; must contribute share of cost.

For example:

Jane Smith is staying long term at a skilled nursing facility. Jane receives social security and a small pension monthly. She is widowed.

Social Security monthly income: $1,500

CalSters Teachers monthly pension: $500

Monthly combines income: $2,000

Monthly Kaiser bill: -$135

Monthly Needs Allowance: -$35

Monthly Share of Cost = $1,830

$1830 is the amount that Jane Smith will be responsible for each month. She still receives her income monthly and is expected to pay the skilled nursing facility $1830 at the beginning of every month where Long Term Medi-Cal is used as a payor source.

Share of Cost is calculated differently when the resident is married and there is a stay at home spouse. It is the county’s objective to always leave the stay at home spouse as much of their combined income as possible. California law allows the community spouse to retain a maximum monthly maintenance needs allowance (MMMNA). The MMMNA or Community Spousal Allowance as it is commonly known is $3948. Please contact Crossroads for further clarification on how the MMMNA / Community Spousal Allowance will be addressed in your specific situation.

.png)

$1,830 + $11,826 = $13,656

$13,656 is the Annual Private Pay Rate (APPR) monthly January 1st 2026